The FBI and cybersecurity experts are sounding the alarm over a sophisticated scam that is rapidly emptying victims’ bank accounts. Authorities warn that this scheme unfolds in three distinct phases, making it difficult for people to detect until it’s too late.

Phase One: Initial Contact

Scammers first establish contact through emails, text messages, or phone calls. They often pose as banks, government agencies, or well-known companies. Victims are lured into clicking malicious links or sharing personal information under the guise of account verification or urgent alerts.

Phase Two: Gaining Trust

Once initial contact is made, fraudsters work to build trust. They may impersonate bank officials or tech support representatives. By using convincing scripts and official-looking documents, they persuade victims to hand over login credentials or grant remote access to their devices.

Phase Three: Account Drain

In the final stage, scammers use stolen information to access bank accounts. They transfer funds, apply for credit, or conduct unauthorized purchases. Some criminals also set up two-factor authentication on behalf of the victim, locking them out of their own accounts.

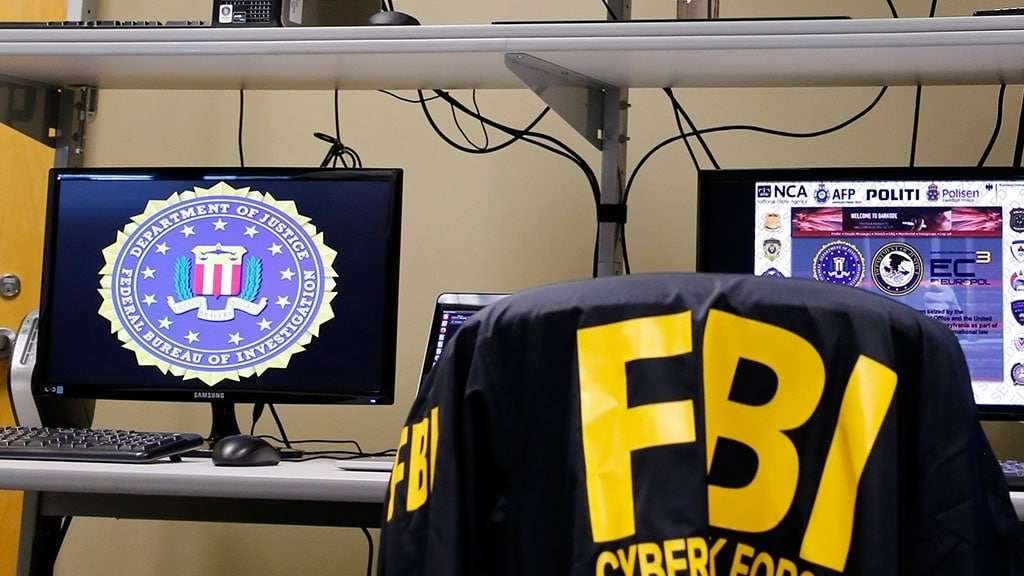

Authorities Urge Vigilance

The FBI emphasizes that no legitimate institution will ask for passwords or remote access. Cybersecurity experts recommend verifying suspicious messages directly with banks, enabling multi-factor authentication, and monitoring accounts regularly. Quick reporting can limit financial losses.

Conclusion

The 3-phase scam is a stark reminder of evolving cyber threats. By staying alert and cautious, individuals can protect their finances from criminals exploiting trust and technology.