Continuous compliance is rapidly becoming the new standard for how enterprises manage regulatory risk. In a world of real-time business operations, cloud systems, remote workforces, and constantly evolving regulations, the traditional model of annual compliance audits is no longer sufficient.

For decades, organizations treated compliance as a periodic activity. Teams prepared for audits once or twice a year, gathered documentation, fixed gaps, and moved on. This approach worked when business environments were slower and more predictable.

In 2026, that reality no longer exists.

Enterprises now operate in highly dynamic ecosystems where systems, data, and processes change every day. Compliance can no longer be an event. It must be continuous.

What Is Continuous Compliance?

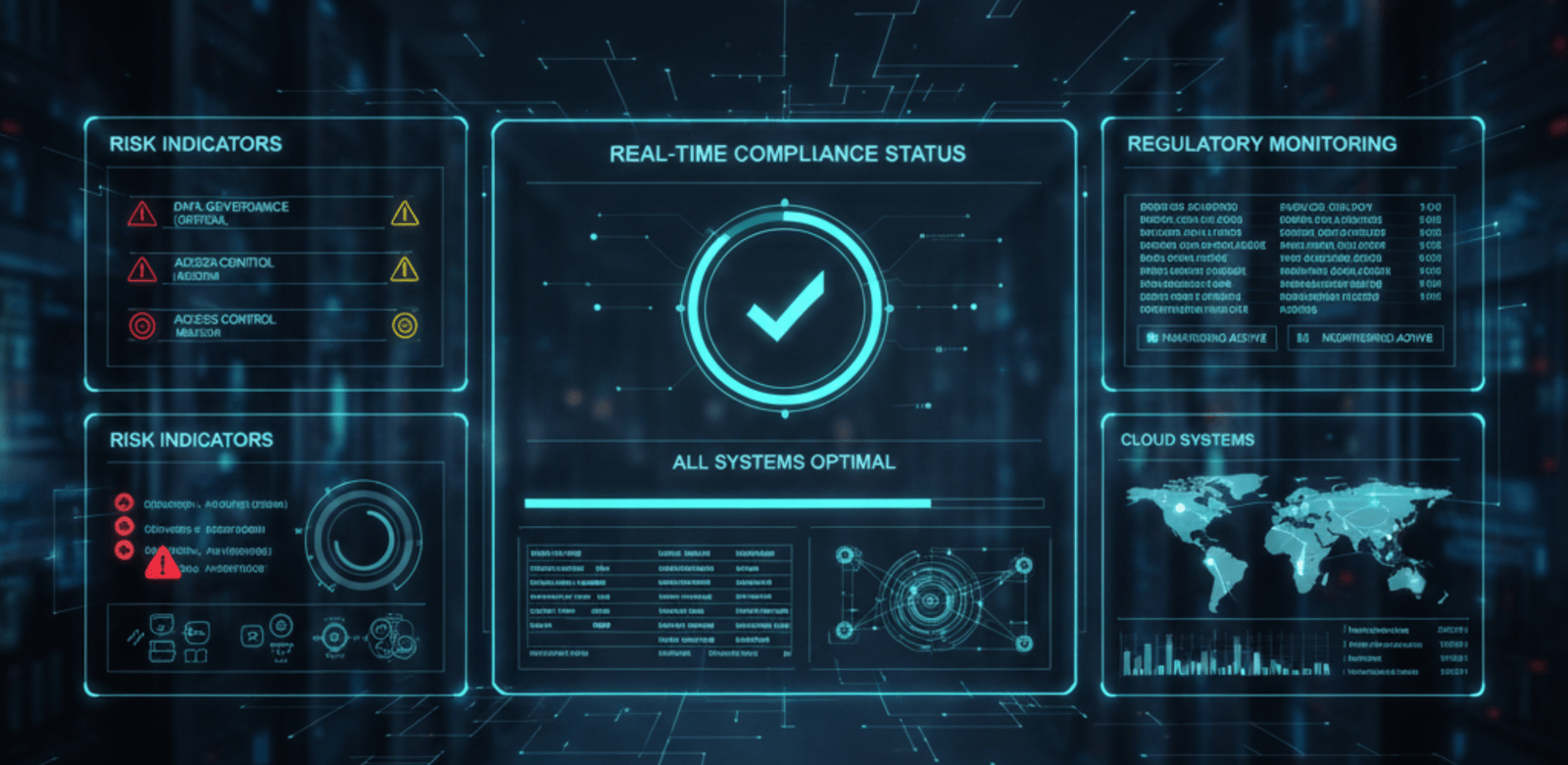

Continuous compliance is the practice of monitoring, validating, and enforcing regulatory requirements in real time across an organization’s systems and processes.

Instead of relying on manual checks and periodic reviews, continuous compliance uses automated tools and policies to ensure that compliance controls are always active and always verified.

It shifts compliance from:

A retrospective activity

To a real-time operational function

Compliance becomes embedded in daily business operations.

Why Annual Audits Are Breaking Down

Annual audits were designed for static environments. Modern enterprises are anything but static.

Today’s organizations deal with:

- Cloud infrastructure

- Distributed teams

- Third-party vendors

- Cross-border data flows

- Constant software updates

This creates a major problem.

By the time an annual audit happens:

- Systems have already changed

- Risks may have already occurred

- Violations may already exist

Audits become snapshots of the past, not protections for the present.

The Key Drivers Behind Continuous Compliance

1. Real-Time Business Operations

Modern enterprises operate in real time. Transactions, deployments, and data exchanges happen every second.

Compliance must operate at the same speed.

Waiting months to validate controls is no longer acceptable.

2. Regulatory Complexity

Regulations are increasing in both volume and complexity.

Enterprises must comply with:

- Data protection laws

- Financial regulations

- Industry standards

- Security frameworks

Manual compliance tracking cannot scale to this level.

3. Cloud and SaaS Environments

Cloud systems change constantly.

New users, services, integrations, and configurations are added every day.

Static compliance models cannot keep up with dynamic infrastructure.

How Continuous Compliance Works

Continuous compliance systems rely on three core components.

1. Automated Monitoring

Systems continuously scan configurations, access controls, data flows, and system behaviors.

They detect deviations from compliance policies instantly.

2. Policy Enforcement

Compliance rules are encoded into systems.

If a system violates a rule, corrective action is triggered automatically.

This prevents violations before they escalate.

3. Real-Time Reporting

Dashboards provide continuous visibility into compliance posture.

Executives can see risk levels at any moment, not once a year.

Business Benefits of Continuous Compliance

Organizations adopting continuous compliance experience:

- Lower regulatory risk

- Faster audit readiness

- Reduced compliance costs

- Improved security posture

- Higher stakeholder trust

Compliance stops being a burden and becomes a strategic advantage.

Cultural Shift: From Compliance as Fear to Compliance as Design

Traditional compliance cultures focus on avoiding penalties.

Continuous compliance cultures focus on building compliant systems by default.

This requires:

- Engineering involvement

- Executive sponsorship

- Automation investment

- Cross-functional collaboration

Compliance becomes part of system design, not a post-deployment fix.

Common Mistakes to Avoid

One common mistake is automating bad processes.

Continuous compliance does not fix poor governance.

Policies must be clear before they are automated.

Another mistake is treating compliance tools as standalone systems. They must integrate with IT, security, and operations platforms.

The Future of Enterprise Compliance

By 2030, most regulated organizations will operate fully automated compliance systems.

Future capabilities will include:

- Predictive compliance risk

- Self-healing controls

- AI-driven regulatory mapping

- Autonomous audit readiness

Compliance will evolve from control to intelligence.

Final Takeaways

Continuous compliance is not just a technology upgrade. It is a fundamental shift in how enterprises manage risk and trust.

Annual audits belong to a slower era of business. Real-time enterprises require real-time governance.

Organizations that adopt continuous compliance today will operate with greater resilience, transparency, and regulatory confidence tomorrow. In the future, compliance will no longer be something you prepare for.

It will be something you live by every day.