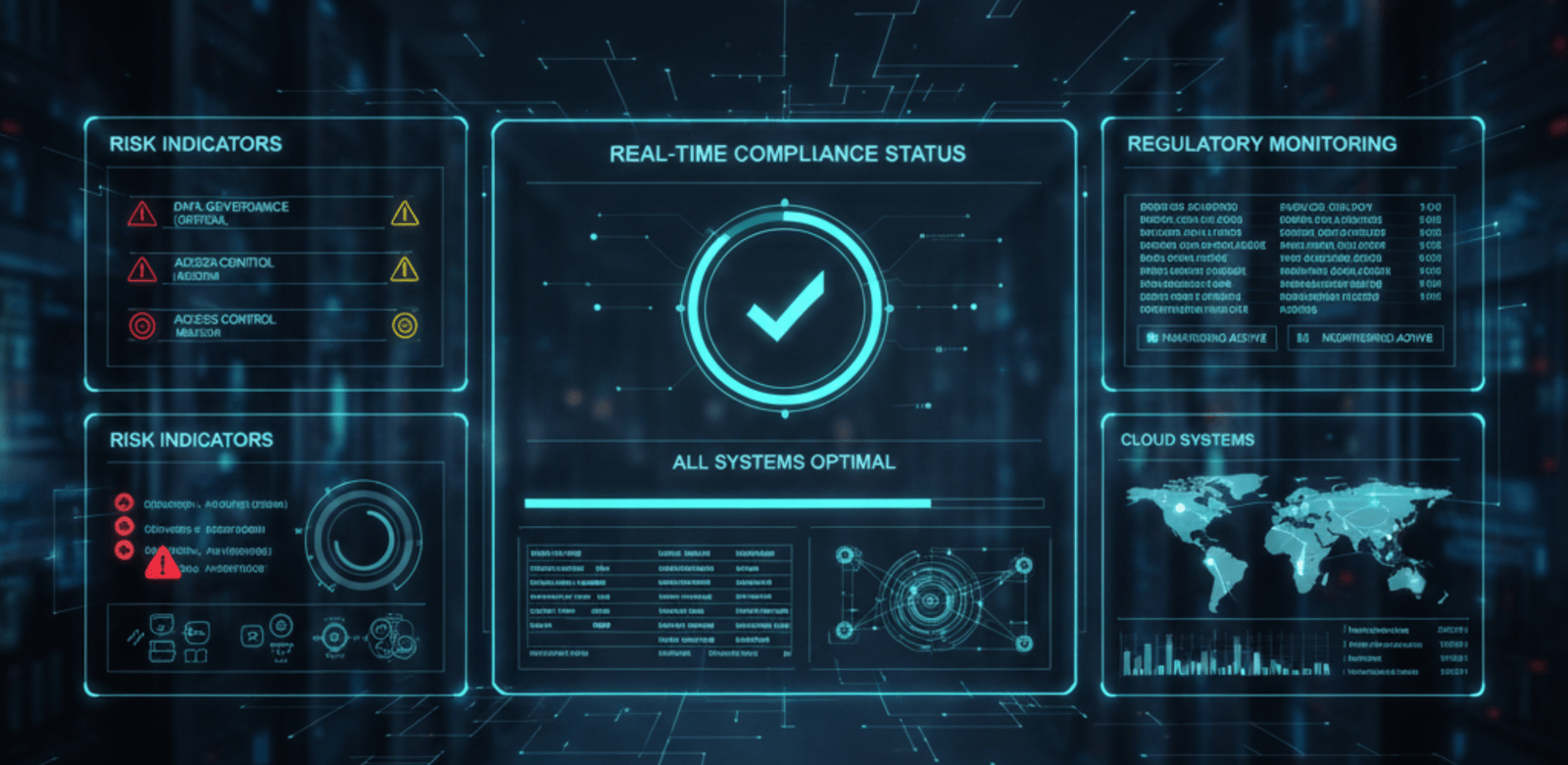

Continuous compliance is rapidly becoming the new standard for how enterprises manage regulatory risk. In a world of real-time business operations, cloud systems, remote workforces, and constantly evolving regulations, the traditional model of annual compliance audits is no longer sufficient. For decades, organizations treated compliance as a periodic activity. Teams prepared for audits once or […]

Category: FinTech

FinOps in 2026: How Companies Control Cloud Costs

In 2026, cloud spending has become one of the largest operational expenses for modern enterprises. As organisations scale across multi-cloud environments and invest heavily in AI-driven systems, financial control is no longer just an economic concern, it is a strategic business priority. FinOps in 2026 represents a new operating model where finance, engineering, and leadership […]

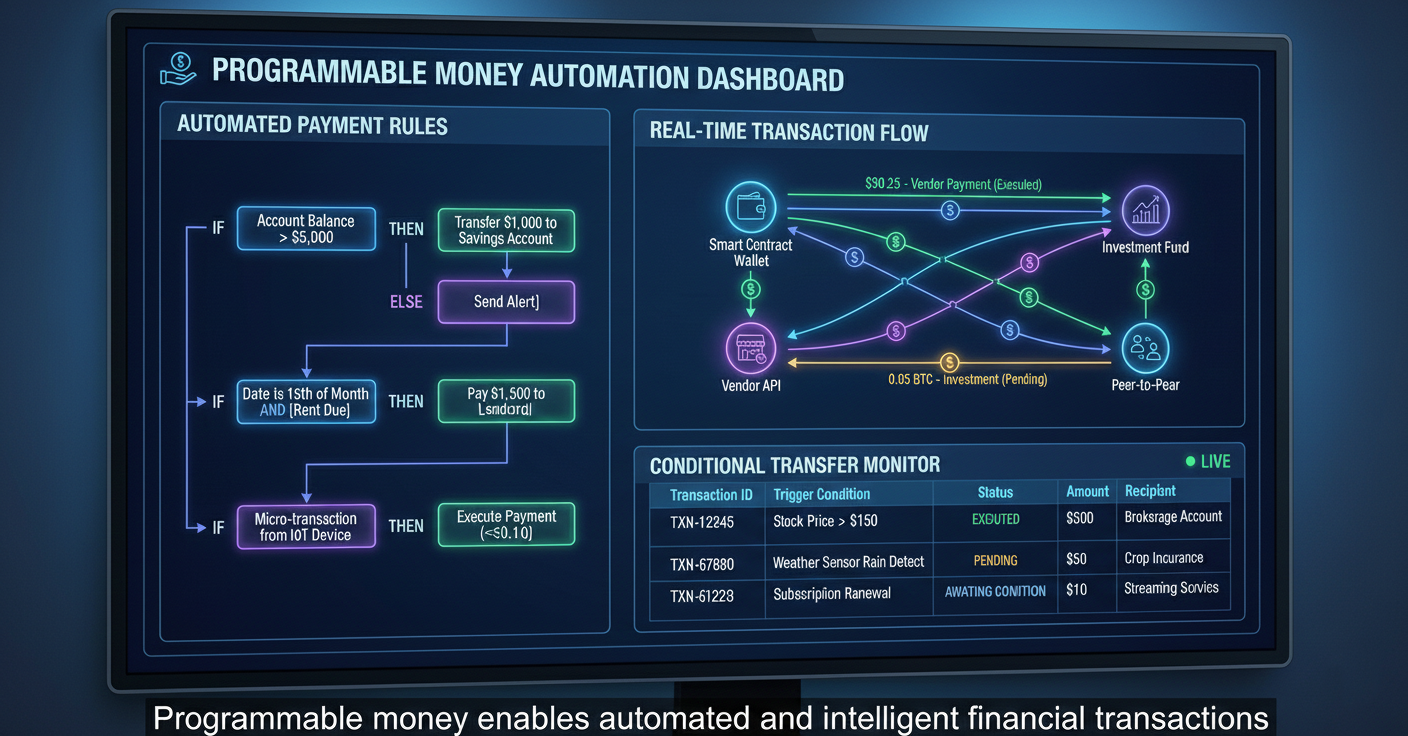

Programmable Money: The Future of Digital Payments and Finance

The way people interact with money is evolving rapidly. Traditional cash, cards, and basic digital wallets are no longer sufficient for modern consumers and businesses. Today, programmable money is emerging as a revolutionary approach, allowing funds to act like code, enabling automated, conditional, and highly flexible transactions. In this digital-first era, these intelligent financial systems […]

The Invisible FinTech: Why Financial Technology Is Disappearing From the User Experience

Financial technology used to be loud and visible. Users logged into apps, entered passwords, confirmed transactions, and manually approved every step. Today, something very different is happening. Financial technology is quietly stepping into the background. The industry calls this shift Invisible FinTech, and it is changing how people around the world interact with money. Invisible […]

FinTech Cyber Risks 2025: How AI and Cloud Innovations Are Redefining Fraud Prevention

FinTech Cyber Risks 2025 are redefining how digital finance manages trust and innovation. With AI, cloud computing, and open banking accelerating global transactions, cybersecurity has become the backbone of financial resilience. A 2025 FinTech Cyber Risks Report revealed a 28% surge in cyberattacks targeting cloud-based financial systems. As the industry expands, FinTech firms must safeguard […]

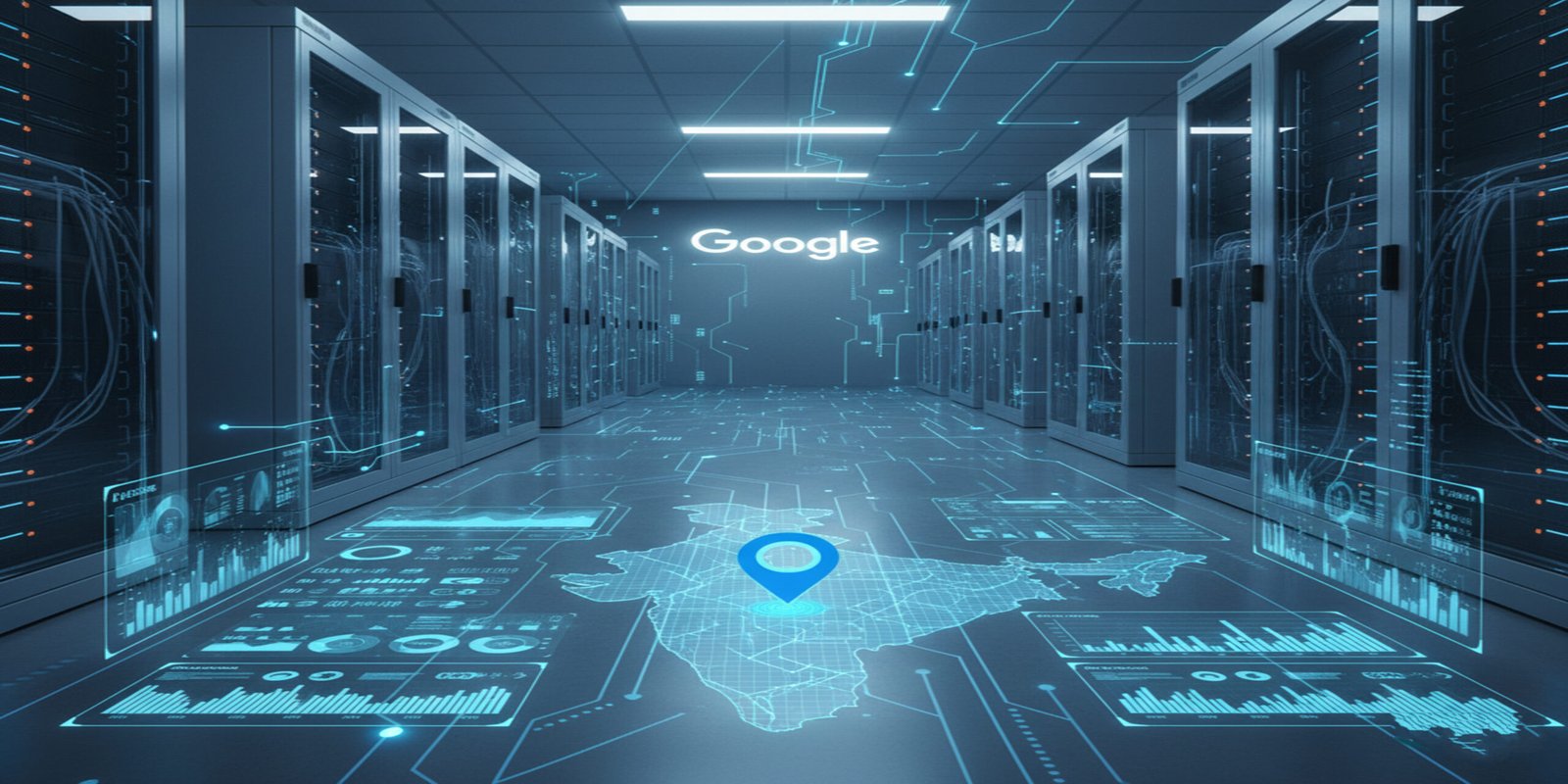

Google’s $15B AI Hub in India: Powering the Next Tech Revolution

Google AI Hub India is more than just an infrastructure investment, it’s a turning point in how the world’s largest tech companies view India’s role in the global AI race. In October 2025, Google announced a $15 billion plan to build a massive AI and data infrastructure hub in Visakhapatnam, Andhra Pradesh. The project marks […]

RBI’s 2025 Fin-tech Reforms: UPI Biometric Authentication, Direct Lending & What’s Next for India’s FinTeq Ecosystem

India’s fintech sector is rapidly evolving like never before. At the 2025 Global Fintech Fest, the Reserve Bank of India (RBI) and NPCI unveiled major updates to UPI, paving the way for biometric payments, face authentication, and IoT-based transactions.Meanwhile, fintech giants like Amazon and Pine Labs are rewriting the rules of lending and digital finance. […]

Fintech Firms Eye Investments in Switching as UPI’s Scale Accelerates.

Growing Focus on Switching Infrastructure As UPI transactions surge to record levels, fintech firms are increasingly eyeing investments in switching infrastructure. The rise in digital payments has created massive transaction volumes that demand faster, safer, and more reliable systems. Switching—the backbone that routes payments between banks and platforms—is now emerging as a critical area for […]

PayPal Sells $7 Billion in U.S. BNPL Receivables to Blue Owl Capital.

PayPal has announced the sale of $7 billion in U.S. buy now, pay later (BNPL) receivables to investment firm Blue Owl Capital. The move reflects PayPal’s strategy to free up capital, strengthen its balance sheet, and expand flexibility in its consumer credit operations. Why This Deal Matters The BNPL sector has grown rapidly, but it […]

UK-Based Fintech Tide Raises $120 Million Led by TPG, Enters Unicorn Club.

A Big Leap for Tide UK-based fintech Tide has secured $120 million in fresh funding, led by global investment giant TPG, officially joining the prestigious unicorn club with a valuation exceeding $1 billion. This marks a major milestone for the company as it continues to scale its digital banking services. Transforming Banking for SMEs Tide […]