In a major milestone for India’s fintech sector, Pine Labs has officially filed for an Initial Public Offering (IPO) worth ₹2,600 crore, signaling its intent to go public and expand its footprint in the growing digital payments ecosystem.

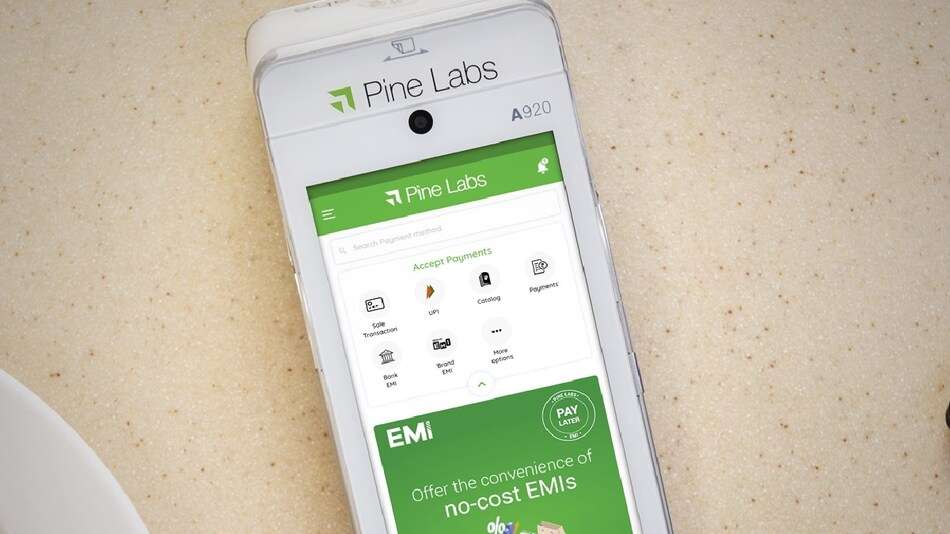

The move marks a significant moment for the Noida-based company, which has evolved from a point-of-sale (POS) machine provider into a full-fledged fintech platform offering merchant commerce, digital lending, prepaid solutions, and buy-now-pay-later (BNPL) services.

A Closer Look at Pine Labs

Founded in 1998, Pine Labs started as a retail automation company before pivoting to digital payments. Today, it serves over 1.5 lakh merchants across India and Southeast Asia, processing billions in transactions annually.

The company is backed by a strong lineup of global investors, including Sequoia Capital, Temasek, PayPal, and Mastercard, which has helped it scale operations and diversify offerings across digital payment segments.

IPO Details

As per the draft red herring prospectus (DRHP) filed with SEBI, the ₹2,600 crore IPO will include a mix of fresh issue of shares and an offer for sale (OFS) by existing shareholders. The proceeds from the fresh issue will be used to:

- Fuel expansion in India and international markets

- Invest in product development and innovation

- Strengthen its lending and BNPL ecosystem

- Enhance technology infrastructure

While the exact timeline for the IPO launch has not been disclosed, industry analysts expect it to roll out in the coming months, depending on market conditions.

Why This Matters

Pine Labs’ IPO is not just a liquidity event for its investors—it’s a litmus test for India’s fintech sector. With increasing regulatory scrutiny and rising competition in digital payments, a successful public listing will:

- Boost investor confidence in the broader fintech market

- Set benchmarks for valuation and performance

- Encourage other Indian fintechs like Razorpay and MobiKwik to explore IPO routes

Moreover, it comes at a time when India is experiencing a surge in digital transactions and UPI adoption, making fintech players more relevant than ever.

Final Thoughts

The Pine Labs IPO could reshape the fintech narrative in India. As it transitions into a publicly listed company, the spotlight will be on how it manages growth, regulatory compliance, and profitability in a dynamic, fast-evolving sector.