The way people interact with money is evolving rapidly. Traditional cash, cards, and basic digital wallets are no longer sufficient for modern consumers and businesses. Today, programmable money is emerging as a revolutionary approach, allowing funds to act like code, enabling automated, conditional, and highly flexible transactions. In this digital-first era, these intelligent financial systems are no longer futuristic concepts; they are actively reshaping payments, commerce, and finance worldwide.

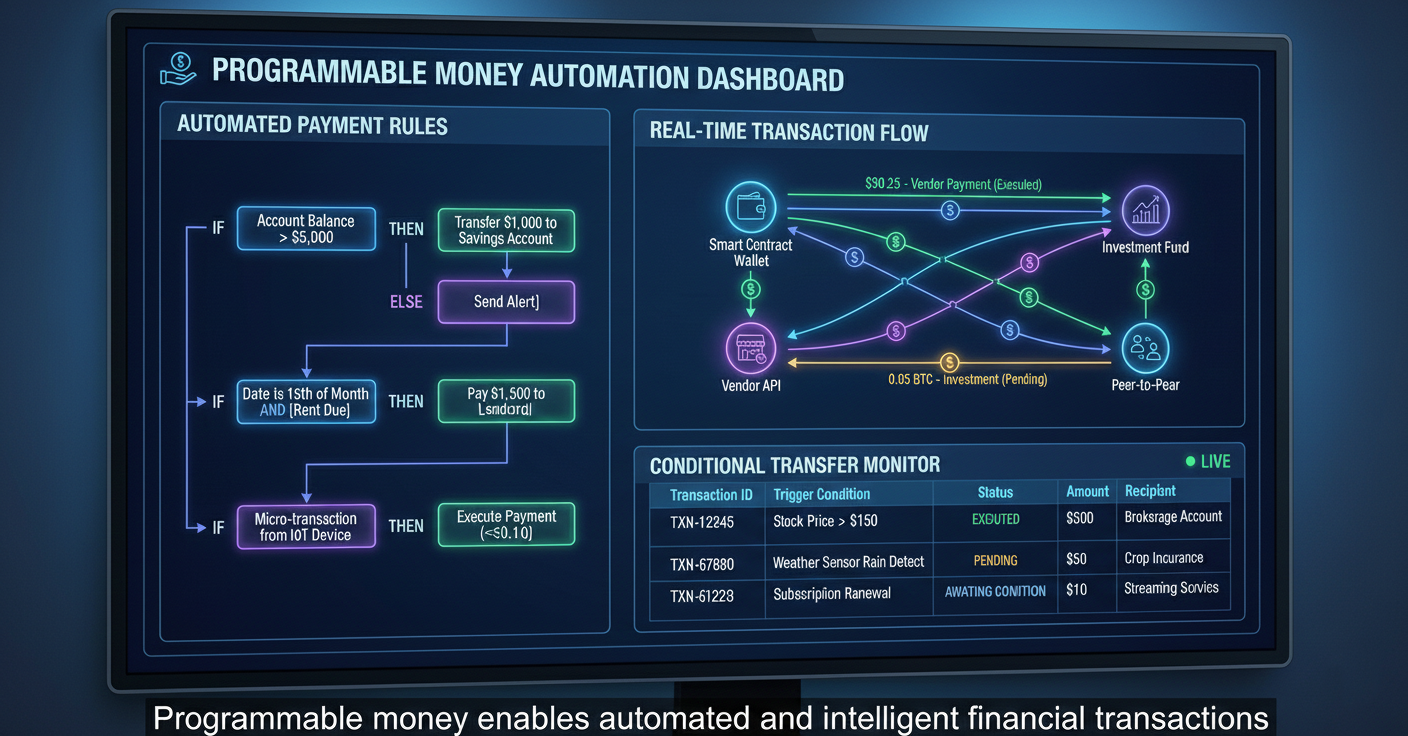

Programmable money enables developers, businesses, and financial institutions to embed rules and automated logic directly into transactions. This means payments can execute automatically when certain conditions are met, subscriptions can self-manage, and financial processes can operate without human intervention. For instance, a company can release payments to suppliers automatically after confirming delivery, or a consumer’s savings account can auto-invest funds based on personal goals.

Understanding the Concept of Programmable Money

At its core, programmable money is digital currency whose behavior is controlled through code. Unlike traditional money, which merely transfers value from one account to another, programmable money can perform predefined operations. Many implementations leverage blockchain or distributed ledger technologies to ensure security, transparency, and immutability.

Key features include:

- Conditional transactions: Payments occur only when rules are met

- Automation: Transfers can be scheduled or triggered automatically

- Interoperability: Compatible across apps and financial platforms

- Smart contracts: Self-executing agreements with predefined conditions

These characteristics make money more responsive, efficient, and intelligent, streamlining operations across individuals and businesses alike.

Why This Technology Is Gaining Global Traction

The interest in automated, code-driven financial transactions is expanding rapidly due to several factors:

1. Instant, Efficient Payments

Legacy banking systems rely on intermediaries and batch processing. Intelligent money systems allow near-instant settlement, removing friction and delays.

2. Reduced Operational Costs

Automation reduces manual workflows, lowers the chance of errors, and saves businesses’ administrative costs while improving accuracy.

3. Enabling Innovative Business Models

From subscription services to microtransactions, programmable funds allow businesses to scale flexible models without additional complexity.

4. Supporting Financial Inclusion

In emerging markets, automated and programmable funds can deliver payments, remittances, or social benefits to individuals without requiring complex banking infrastructure.

Real-Life Applications of Programmable Money

Businesses and developers are already applying programmable financial systems in real-world scenarios:

- Decentralized Finance (DeFi): Automated loans, staking, and yield farming rely on programmable currency for execution.

- Payroll automation: Employees can receive wages automatically based on hours or milestones.

- Insurance payouts: Claims can be settled instantly once conditions are verified.

- Subscription services: SaaS or streaming platforms can adjust payments dynamically depending on usage.

These examples highlight how intelligent money systems streamline workflows while enhancing reliability and transparency.

Balancing Speed and Security

While automation is powerful, it requires strong safeguards. Smart contracts must be error-free to prevent vulnerabilities, and compliance with financial regulations remains crucial. Many institutions combine:

- Blockchain for immutable transaction records

- Multi-signature protocols to prevent unauthorized transfers

- Auditable contracts for regulatory compliance

Institutions ensure that automated transactions remain safe and accountable.

The Road Ahead

Automated and programmable financial transactions are redefining how individuals, businesses, and institutions handle money. Beyond payments, applications extend to lending, investment, insurance, and cross-border settlements. By embedding intelligence into currency, the financial ecosystem becomes more efficient, adaptable, and inclusive.

As adoption grows, focus will shift from learning how to use programmable money to strategically leveraging its capabilities. Organizations that embrace these systems can unlock smarter operations, improved user experiences, and innovative financial solutions.

Conclusion

Programmable money is transforming finance from a static system into a dynamic, automated ecosystem. By embedding rules and intelligence into digital currency, businesses and individuals can benefit from faster payments, lower costs, and smarter financial decision-making. Globally, these systems enhance financial inclusion, simplify complex transactions, and enable innovative business models. As financial services evolve, automated and intelligent money will be a cornerstone of a more efficient, transparent, and inclusive financial world, one where funds not only hold value but also perform intelligent actions that simplify lives.

Great perspective — I hadn’t considered that angle before.

Very well presented. Every quote was awesome and thanks for sharing the content. Keep sharing and keep motivating others.

i enjoy reading this great article, i have shared it many times on my website and started following you, Do you post more often ?? i am the owner of https://webdesignagenturbayreuth.de/ a webdesign agency in bayreuth Germany, webdesign agentur bayreuth, you can link up if you are interested. Thank you

That is the proper weblog for anybody who desires to seek out out about this topic. You notice a lot its almost laborious to argue with you (not that I truly would need…HaHa). You definitely put a brand new spin on a topic thats been written about for years. Nice stuff, just great!