RUUT Prepares to Disrupt UK Banking

A fresh competitor, RUUT, is preparing to step into the UK digital banking scene. With the rise of fintech innovation, RUUT aims to offer customers a smarter, faster, and more transparent way to manage money.

Challenger Banks on the Rise

Over the past decade, digital-only banks such as Monzo, Revolut, and Starling have reshaped financial services. RUUT’s arrival signals that competition remains strong. The company is expected to introduce features that address customer frustrations with traditional banks.

Focus on Customer-Centric Services

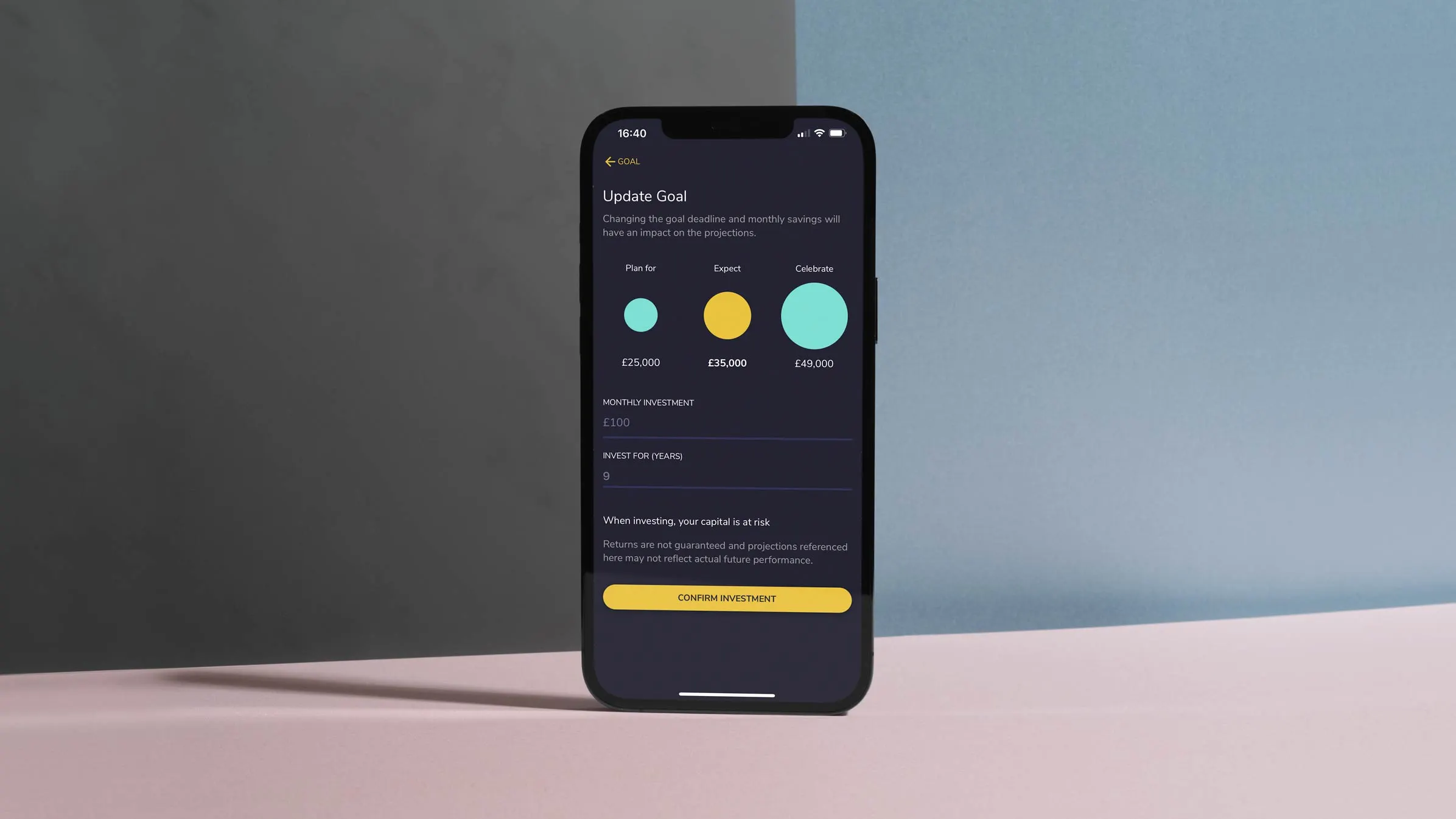

According to industry insiders, RUUT will emphasize customer-first digital banking. This includes seamless app experiences, lower fees, real-time transactions, and AI-driven financial insights. The goal is to empower users with better control over their money.

Why the UK Market?

The UK is considered one of the most advanced fintech hubs in the world. Consumer openness to digital banking, strong regulatory support, and rapid tech adoption make it a perfect launchpad. RUUT’s entry highlights ongoing opportunities in this market.

Competing with Established Fintech Leaders

RUUT will face strong competition from established digital banks. However, experts believe that innovation in areas like cross-border payments, savings tools, and personalized financial management could set RUUT apart.

The Future of Digital Banking in the UK

The entry of RUUT underscores how digital banking continues to evolve. With more consumers shifting from branch-based banking to mobile-first solutions, the demand for flexible and secure financial services is rising. RUUT plans to tap into this growing trend.

Final Thoughts

RUUT’s entry into the UK digital banking market highlights the sector’s ongoing transformation. As competition intensifies, consumers stand to benefit from better products, improved services, and more choices in managing their finances.