Global Headwinds Hit Home

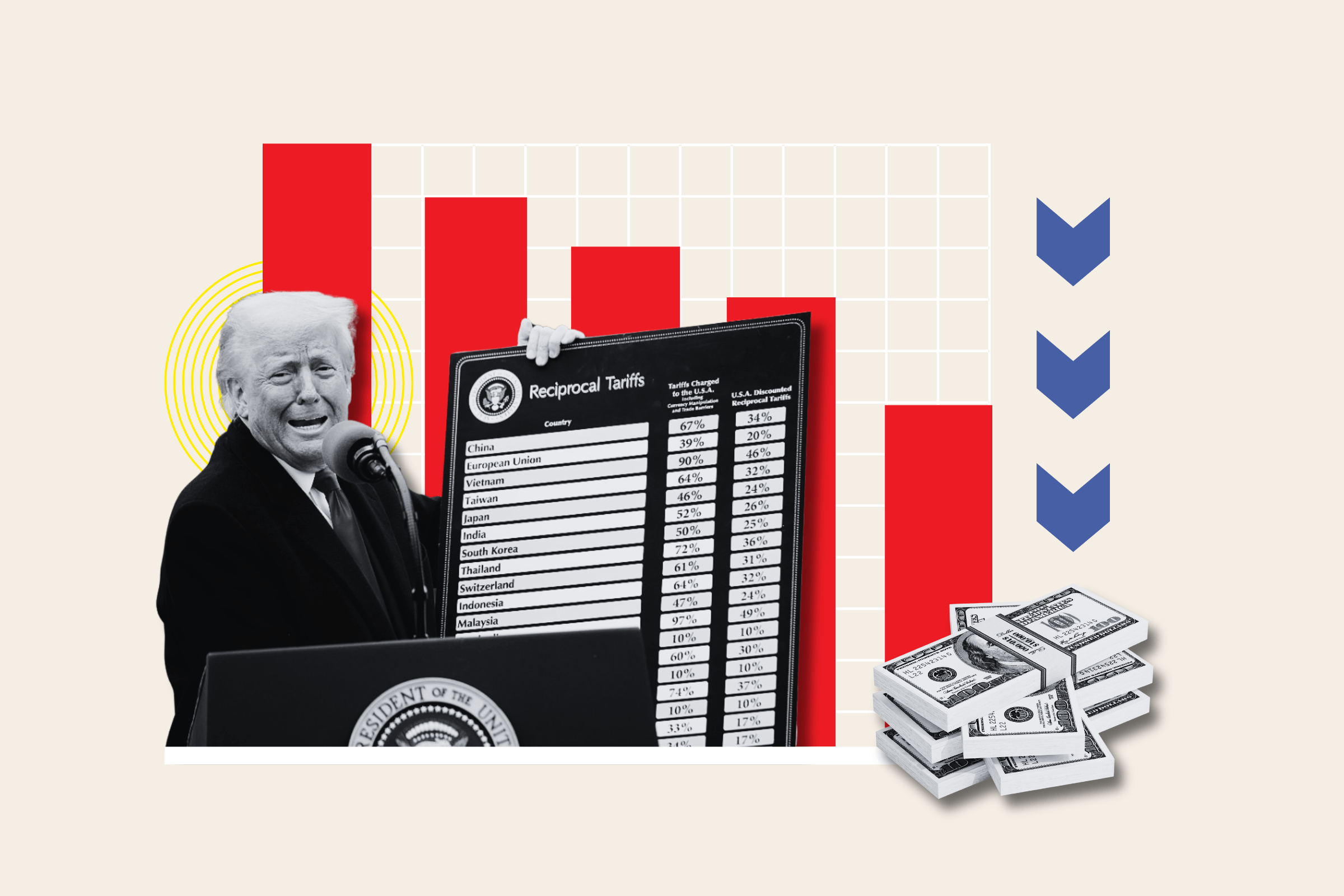

With Donald Trump signaling a potential return to aggressive tariff policies, global markets are bracing for renewed trade tensions. For India, this development could directly impact the Reserve Bank of India’s (RBI) monetary policy decisions in the upcoming quarters.

Pressure Builds on Inflation and Imports

Trump’s proposed tariffs on Chinese goods and possible duties on foreign imports could trigger a global commodity price hike. For India, a rise in oil prices and raw material costs would feed into inflation, narrowing RBI’s room to cut interest rates or hold them steady.

Additionally, the rupee may come under pressure due to potential capital outflows, as global investors retreat to safer markets. A weaker rupee could further raise import bills, compounding inflationary risks.

Balancing Growth with Stability

India’s economy is showing signs of steady recovery, but it remains sensitive to global shocks. The RBI has so far maintained a balanced tone—supporting growth while keeping inflation within target. However, if Trump’s tariffs escalate into a trade war, the RBI may be forced to adopt a more cautious stance.

Rate hikes might be back on the table, not because of domestic demand, but due to external volatility impacting inflation and currency stability.

Uncertain Road Ahead

The RBI’s upcoming policy decisions will likely factor in not just domestic data but also global cues, especially U.S. trade and fiscal policies. Markets will watch closely how the central bank navigates the tricky path between supporting growth and containing imported inflation.

Conclusion

Trump’s tariff warning is more than just a U.S. political move—it could significantly influence India’s financial outlook. As global uncertainties rise, the RBI must weigh external shocks against internal priorities to make the right monetary choices.